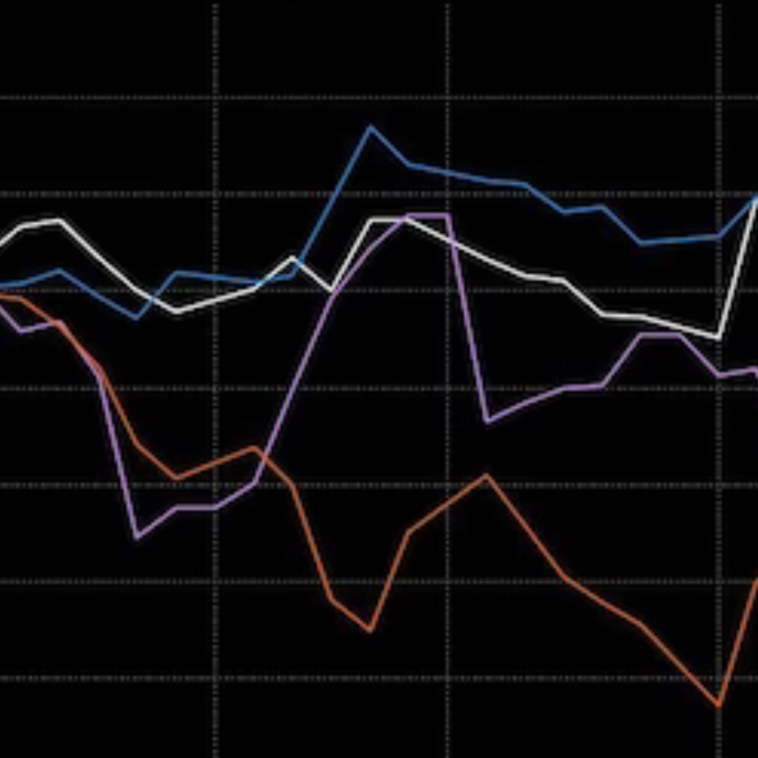

China’s economic growth unexpectedly slowed down and its economic slump is causing damage to the big American companies. From luxury brands to car makers, China’s economic slowdown is causing a problem for the Europeans, and more trouble is coming for businesses heavily reliant on demand in the Asian economic

China’s economic slump a problem for the big companies

These are some of the renowned companies that have been hurted badly: Hugo Boss AG, Burberry Group Plc, and Daimler Truck Holding AG as customers there are turning more cautious. LVMH joined the growing list , reporting that sales in the region that includes China dropped 14% in the second quarter.

China sales plunged 30% in the first half and are cutting production. Now consumers are less preferring European goods and spending less on European goods, causing a severe implication for profits as well as creating risks for share prices, company valuations, even jobs.

A major concern for multinational companies

Companies are facing great difficulties as their profits are declining. For instance, shares in Hugo Boss and Burberry were among those to suffer most as the two fashion groups issued profit warnings. Luxury brands are mostly struggling in the lucrative Chinese market, and the slowdown is now putting them under pressure. For example, a German car maker Porsche AG flopped under pressure because of short supplies.

“We are concerned about the exposure to China,” said Arun Sai, senior multi-asset strategist at Pictet Asset Management. “Profit warnings from European companies again this earnings season have already flagged the risk of weaker-than-anticipated demand from China, especially the consumer.”

China didn’t try to improve its condition

Earlier Chinese authorities had announced about the growth-friendly measures at their recent twice-in-a decade Third Plenum. However they didn’t try to improve their economy or find the actual reasons behind the slumped. It means European companies that benefited during the country’s boom time are most likely to continue facing a problem againsts the goods and services of China.

“China’s domestic weakness has been a multi-year drag but was overshadowed by strength in the US,” strategists led by Gerry Fowler said in a note. “Now that both regions appear to be slowing, the nascent European recovery is vulnerable, again, to external forces.”

Sunil Krishnan, head of multi-asset funds at Aviva Investors said “people will be looking particularly at guidance from the more export-sensitive European names, just looking for any signs of how they’re seeing both the impact of China as an end market, but also as a competitor. That is going to be an important theme.”

GIPHY App Key not set. Please check settings